A Notary Signing Agent is the crucial link when it comes to completing a loan closing.

The “closing” is the last step in buying and financing a home. The “closing,” also called “settlement,” is when you and all the other parties in a mortgage loan transaction sign the necessary documents.

Loan documents are a detailed requirement part of any real estate transaction. Without an experienced Notary Signing Agent, these important pieces would never be completed on time which can cause delays in funding your next home purchase or refinance!

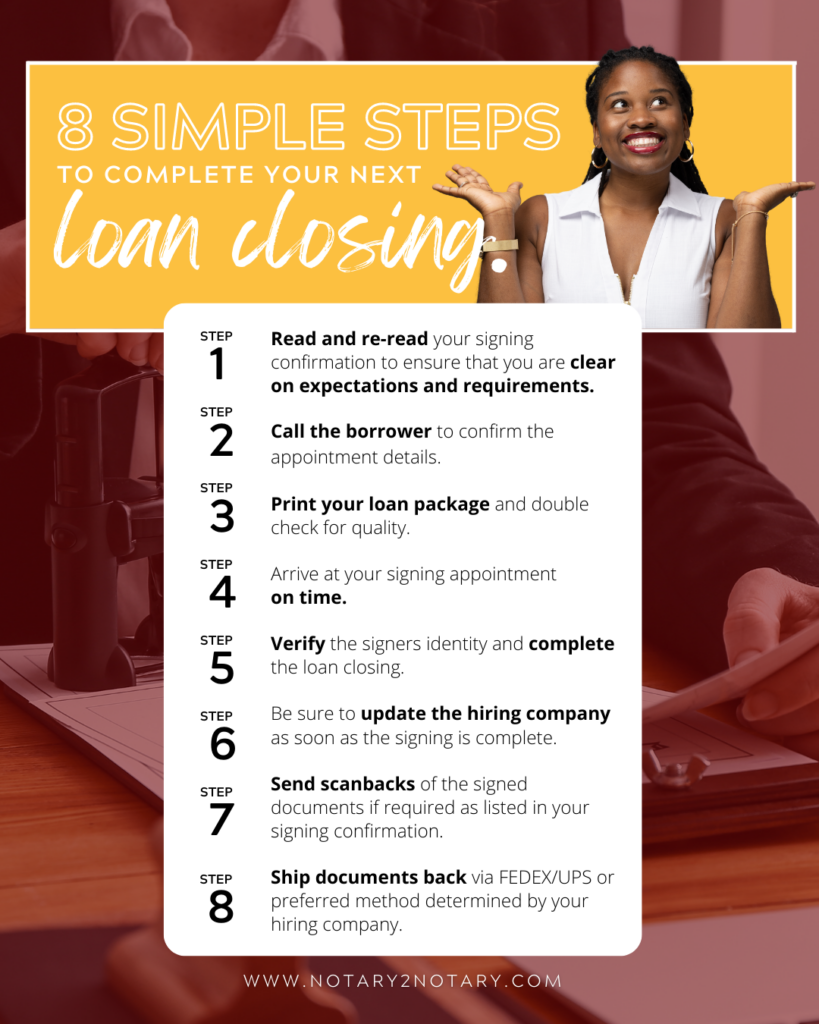

Use these 8 simple steps to ensure your loan closing process checks all the necessary marks:

STEP 1: Read and re-read your signing confirmation to ensure that you are clear on requirements and expectations.

STEP 2: Call the borrower to confirm the appointment details.

STEP 3: Print your loan package and double check for quality.

STEP 4: Arrive at your signing appointment on time.

STEP 5: Verify the signers identity and complete the loan closing.

STEP 6: Be sure to update the hiring company as soon as the signing is complete.

STEP 7: Send scanbacks of the signed documents if required as listed in your signing confirmation.

STEP 8: Ship documents back via FEDEX/UPS or preferred method determined by your hiring company.